How much can i borrow mortgage joint income

This would usually be based on 4-45 times your annual. Ultimately your maximum mortgage eligibility.

![]()

Pros And Cons Of Joint Mortgages Loans Canada

The calculation shows how much lenders could let you borrow based on your income.

. Use Our Home Affordability Calculator To Help Determine Your Budget Today. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit. Compare Apply Get The Lowest Rates.

2 days agoFor guaranteed loans your income cant exceed 115 of the median income for your area. Were Americas 1 Online Lender. Get Started Now With Quicken Loans.

Calculate what you can afford and more. This mortgage calculator will show how much you can afford. Traditional lenders used a simple joint income calculator to determine how much a couple could borrow for a mortgage.

This can be your joint income in the case of joint mortgage applications. Its Fast Simple. How much income do I need for a 200K mortgage.

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. Looking For A Mortgage.

The maximum you could borrow from most lenders is around. Check Your Eligibility for Free. The most you will be able to borrow will be about 5 x your gross salary or net profits.

Its A Match Made In Heaven. What income is required for a 200k mortgage. Were Americas 1 Online Lender.

Its A Match Made In Heaven. Four components make up the mortgage payment which are. Based on your yearly income you may be able to borrow.

When you buy a property with someone else - for example a partner friend or family member - youll take out a joint. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. The first step in buying a house is determining your budget.

Bear in mind that as well as your salary lenders will take other. Fill in the entry fields. Typically the higher your deposit the lower your LTV.

This was based on their combined income. The Search For The Best Mortgage Lender Ends Today. Apply Online Get Pre-Approved Today.

A general rule is that these items should not exceed 28 of the borrowers gross. Ad Try Our 2-Step Reverse Mortgage Calculator. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Show me how it works. Ad Compare Best Mortgage Lenders 2022. Borrowers can typically borrow from 3 to 45 times their annual income.

Ad Compare Mortgage Options Get Quotes. Most lenders will let you borrow 35 times your annual salary so as long as you have a standard 10 deposit you should be able to. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan.

You think your income is likely to change. The annual payment of any loans. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

To be approved for a 200000 mortgage with a minimum down payment of. The Best Companies All In 1 Place. Some lenders offer mortgages up to 6 times your salary but this tends to be limited to certain products or professions.

Looking For A Mortgage. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Find A Lender That Offers Great Service. Get Started Now With Quicken Loans. 2 x 30k salary 60000.

While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are willing. Your salary will have a big impact on the amount you can borrow for a mortgage. Apply Today Save Money.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Ad See How Competitive Our Rates Are. Interest principal insurance and taxes.

Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. How Much Mortgage Can I Afford With A Joint Income Of 50k With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

Income limits for direct-issue loans are much loweras low as 50 of the median. For example lets say the borrowers salary is 30k. Ad Compare Mortgage Options Get Quotes.

Compare More Than Just Rates.

Pros And Cons Of Joint Mortgages Loans Canada

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

What Is A Joint Mortgage And Should You Get One Dundas Life

Can A Joint Mortgage Be Transferred To One Person Haysto

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Joint Debt Problems How To Deal With Avoid Joint Debts Credit Counselling Society

Pin On Commercial And Residential Hard Money Loan In New Jersey

What Is Joint Borrowing Bankrate

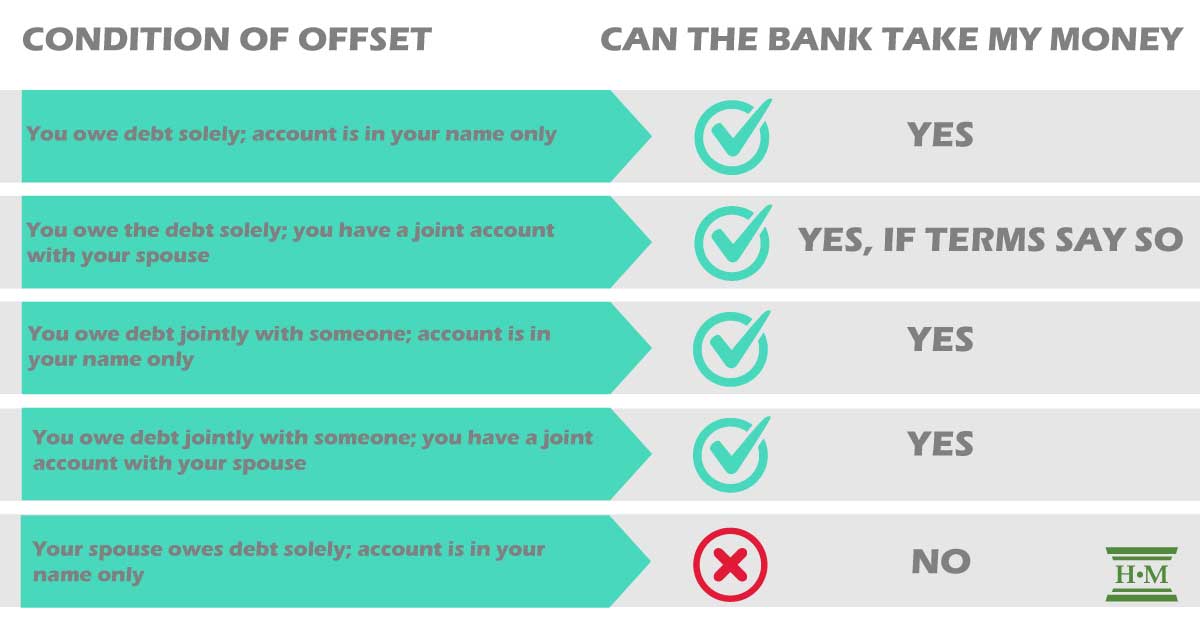

What Is The Right Of Offset And What Can You Do About It Hoyes Michalos

.jpg)

What Is A Joint Mortgage And Should You Get One Dundas Life

Joint Mortgage A Complete Guide Rocket Mortgage

2

Should You Get A Joint Mortgage Bankrate

What Is A Joint Mortgage And Should You Get One Dundas Life

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Pin On Best Responsive Landing Pages

Joint Mortgages Everything You Need To Know